21st July 2020

2020 has been a year of disruption – with swarms of locusts in Africa in India, enormous fires in Australia, social disruptions and of course COVID-19. These issues have highlighted systemic problems in life that are usually hidden. We know how inter-dependent we are on each other and on our natural world. Now is the time to take a step back, take responsibility and become more sustainable.

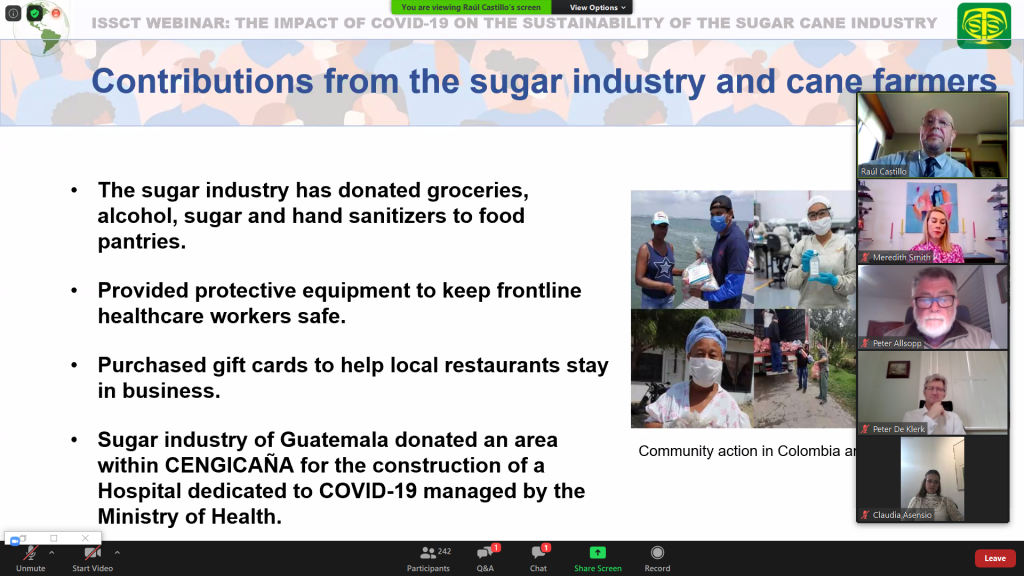

On Monday 20 July, ISSCT organised a webinar in collaboration with Bonsucro and the International Sugar Organization looking at the impact of COVID-19 on the sustainability of the sugarcane industry worldwide.

Over two hours, we looked at the social and livelihood impacts among producer communities in the Americas, Australasia, Asia and Africa. We also looked at public health considerations and the impact of COVID-19 on business continuity and the international trade and macro-economic impacts of COVID-19 in the short and medium term.

A recording of the webinar is available on our YouTube channel and a summary of each panellist is below.

The Americas

America is the largest region for sugarcane production in the world, with Brazil being the highest producing country. In Latin America, sugarcane makes up for 50% of the production area. The World Health Organization (WHO) says that the peak has not yet hit the Americas. But countries such as the USA, Mexico and Brazil have been hit hard by the virus. However other regions have had very few cases and are returning to normal.

The virus poses a threat to sugarcane producers if quarantines are extended or reintroduced in the autumn with the harvest season begins. There is also a lack of information on the characteristics of the pandemic and prevention in local communities.

The cost of production has increased due to the need to create hand sanitising stations and new working protocols. In addition, border closures and market disruptions have created logistical problems and a shortage of inputs. Bioethanol suffered a drop in sales due to low fuel demand due to national lockdowns.

Australaisa

Similarly to the Americas, the potential impacts of COVID-19 in the Pacific and Asia are focused on the reduced output of sugar due to shortage of inputs, reduced number of workers and restrictions on travel.

In addition, lockdown has impacted the sale of food and beverage sales – especially in the Northern hemisphere where it is summer. In India there has been a significant reduction on the volume of drinks purchased.

Pacific countries have had a relatively low level of COVID-19 and all industries are in their harvesting season. However, there are restrictions on travel to prevent any further spread of the virus and regular precautionary measures are in place.

In Southern Asia the major producing countries are India, Thailand, Chin and Pakistan, all of which have a big variety in type of farms – from smallholders through to large plantations. At the moment, sugarcane is in the growing phase.

India has been hit hard by the virus and still has thousands of active cases. The coming harvest is expected to be 31 MT compared to 27 MT for the previous season. At the beginning of the pandemic, ethanol production was low but it’s already bounced back.

However, Thailand has been affected by server drought and the harvest is expected to be significantly lower. In addition there is a shortage of labour as movement if migrant workers remains restricted.

Africa

In Africa, 27 out of 54 countries produce sugarcane and collectively it accounts for 7% of the world market. According to WHO, there are more than 700,000 COVID-19 cases and 15,000 deaths across the continent – with South Arica being the hardest hit.

An estimated 65,000 people are employed in the sugarcane industry in South Africa and – 270,000 are indirectly employed. In order to maintain food supplies, the agricultural sector was exempt from quarantine. As a result, food production communities have been less affected than other sectors. However, precautionary measures are in place to limit the spread including PPE, focus on hygiene and washing hands more regularly. This all comes at a cost to farms and mills. There is also a challenge on migrant workers being able to travel and containing the virus.

There is huge variety in the way that COVID-19 has hit countries in Africa, for example Mauritius hasn’t reported a new case in the past 11 weeks. However, Cote d’Ivoire and Nigeria both have active cases but very few incidents at factories and on sugar estates. Generally, there are restrictions on movement that could affect migrant workers and harvest, and ultimately the price. In conclusion, the impact in Africa is limited at this point, but it could worsen.

Public health implications

Pantaleon is a global company, and so the first thing the team considered is the socio-political context in which it operates. It’s important to consider that each country has been hit in a different way – and governments are responding with different measures. It’s also vital to consider the mental health of the individual because of the stress around the virus.

Pantaleon has done a lot to consider the living conditions of the people – including the physical space and environmental space and the working conditions of family members and whether they could increase the risk of contracting the disease and then passing it along at work.

The team has also considered the community level and thought about what people have. There are some every stringent shut downs – so it’s been essential to ask whether basic services such as water, electricity and transportation are running.

The virus has posed a question for organisations to understand how to quantify the issues and react. Claudia Asensio commented that it’s important to think about how to follow the scientific literature. There are so many divergent views – so how does your company decide who to listen to? “If we’re going to follow the science, we need to think which science to follow as there are huge implications on how the virus is transmitted and therefore what is the best PPE and how people’s flow of the disease be treated.”

Examples of health policies in place for COVID-19 at Pantelon include but are not limited to: assessment of individual work conditions, vulnerable population placed on leave, contact tracing, international travel, disinfection before starting shifts etc.

There are inequality issues being faced by different communities and organisations have to balance individual rights with social good. For example, prioritising people with higher health risks. At this time, building and maintaining trust with employees and community members is vital.

Business continuity

Meredith Smith mentioned that the loss of colleagues in Italy at the beginning of the pandemic quickly made the pandemic a reality for ED&F Man. As such, a crisis team was quickly assembled that includes representation from all regional teams. The team meets weekly to coordinate the different responses as the pandemic changes.

ED&F Man has responded by banning travel and working on using different technology to help communicate with suppliers, colleagues and customers. In addition, in countries that allow it, safe return to offices has been implemented with check lists, use of PPE and social distancing.

Re-imagination is key. Now is great time to redefine how the company works so employees have the tools to do their best. ED&F Man can’t function without its people – so welfare is important. The team has seen the importance of planning and communication. The way to survive is to flexible.

Sustainability is still very important. We have kept the Bonsucro Members’ Council meetings during the pandemic and there’s been more consistent participation in these meeting. People in business are making sustainability a priority.

International trade and macro-economics

The International Sugar Organization predicts that world exports are likely to increase in the 2019-20 season. Brazil’s dominance in world market for export continues – in the past three months there have been record volumes – the expectation is that this will go into July and beyond. However, Brazil has high infection rates on COVID-19 – which is a concern.

Generally, importers are looking for lead times, good quality and smooth logistics. For the export, it’s looking at matching quality requirements, loading facilities.

It seems as though here will be a second year of decline in production globally, but the increase in prices is yet to be seen. From COVID-19, we have seen a decline in the sales of beverages, desserts, pastries and coffee. However, eating-in has helped balance this due to ‘baking, biscuits and boredom’.

Employment in harvesting, logistics and mills means that the sugarcane industry, like few others in agriculture is very exposed to the impact on the labour force that’s available. And because of this, there is concern in the larger employing economies such as India.

There has been a premium on white sugar compared to raw sugar and freight prices. This is a temporary feature as the Brazilian raw sugar starts to reach refineries. There is some concern over food security globally because due to higher domestic prices triggering international buying programmes.

In conclusion, the global deficit should narrow as a result of consumption changes and depend on the end of the pandemic. Production for the next season will be higher – however we may see disruptions on labour – especially in Thailand and India. In general, the global trade issues should ease with the broadening of origins.

All the presentations from the webinar can be downloaded from Google Drive, here.